Free Download Weekly Paycheck Pdf

Contents of a Pay Stub

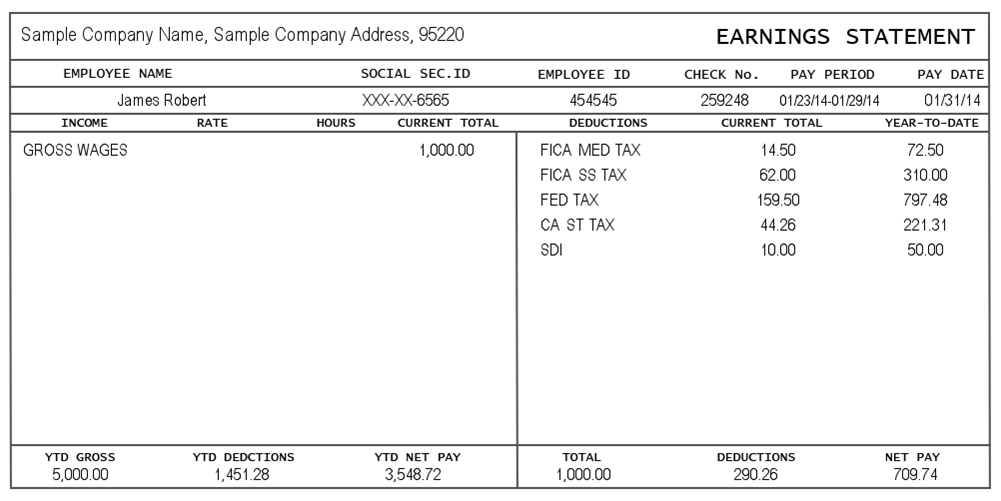

A pay stub is that little slip of paper that is attached to a paycheck. It allows employees to keep a record of payments received. Generally, it looks something like this:

When an employee receives a paycheck, he or she can free the pay stub from the check and file it away to use at the end of the tax year. A pay stub form should contain some basic information that can be divided into three components - company information, employee information and payment details. What follows is a summary of each component.

Company Informatio

This is pretty basic. Company information includes the company's DBA name and address. It is generally listed either along the top or bottom of the pay stub.

Employee Information

This section must include an employee's full legal name and employee ID number. It may also include social security information. If you mail paychecks to your employees, this section should also include the employee's address. An easy way to organize this information is to list it along the top row of the pay stub.

Payment Details

This is the more extensive component of the pay stub. Basically, it should summarize how much money the employee has earned during the applicable pay period, as well as how much he or she has earned thus far this tax year. A pay stub template would consist of the following parts:

Check Number

This is the number of the check issued the employee. This comes in handy should the check need to be cancelled or tracked down.

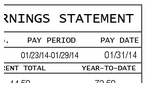

Pay Period and Pay Date

These are pretty self-explanatory. The pay period section should list the beginning date (aka: 1/11/21) and end date (aka: 1/25/21) of the pay period in question. The pay date section should provide the date on which the check is issued. Generally, this is a few days after the end date of the pay period.

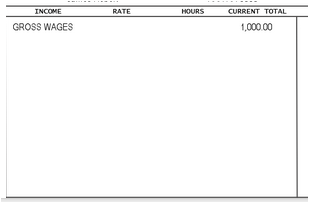

Amounts and Types of Income

This is the real meat of the pay stub. It must provide the number of hours worked, both regular and overtime. It should also specify the amounts earned for each type of income. Income types include gross wages or "regular" (in other words, hourly), as well as direct tips for food service workers and other tippable employees. Hours and amounts must be provided for both this particular pay period and the total tax year to date, often abbreviated as "YTD." This section should also include the hourly rate earned by the employee.

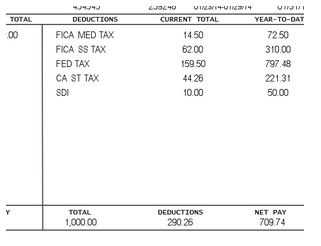

Deductions

A pay stub should also list deductions, for both this pay period and the YTD. Common deductions include federal tax, state tax, Medicare, and social security. The stub must provide both an itemized list of deducted amounts and the sum of all deductions.

Paycheck Stub

A paycheck stub, also known as a pay slip, wage slip, or pay stub, is a document a company provides to employees that details their income and deductions. It can be distributed as a hard copy or as an electronic pay stub. On a physical paycheck, a paycheck stub is generally attached to the same piece of paper. If employees are paid by direct deposit to their bank account, they can access printable paycheck stubs via the employer's online payroll system.

A paycheck stub should include the following information:

-

Employee information, including name, social security number, and address.

-

Employer information, including name and address.

-

The dates of the pay period.

-

Employee pay rate. The hourly rate should be listed for hourly employees.

-

Gross pay, earnings before taxes, deductions, and employee contributions are taken out. For hourly employees, the hours worked should be listed. For salaried employees, the default is 40 hours a week. The pay stub should also list vacation pay and any bonuses, as well as overtime if the employee is eligible and any overtime hours worked.

-

Taxes withheld, including federal income tax (based on an employee's W-4/exemptions), Social Security and Medicare (FICA), State Disability Insurance (SDI) and, if applicable, state or local taxes. States set their own income tax rates; some have bracketed tax rates, like the IRS, some have a flat rate, and some states have no state income tax whatsoever. Some cities require payment of local taxes, which pay for local government services.

-

Deductions, including deductions for health insurance and life insurance, and any deductions due to judgements rendered against the employee, including child support payments or another legal settlement.

-

Employee contributions, including contributions to retirement plans/pensions, the employee's share of FICA tax, union dues, health insurance, and life insurance.

-

Net pay, the total amount the employee actually takes home in their paycheck after all taxes, contributions, and deductions are subtracted from gross earnings.

-

A year to date total of the employee's gross salary, taxes, deductions, and net salary.

-

Additional information, such as accrued sick leave, as required by state law.

Additional Pay Stub Resources & Information:

https://www.thebalancecareers.com/what-is-included-on-a-pay-stub-2062766

https://smallbusiness.chron.com/create-pay-stub-excel-director-new-business-29227.html

https://www.zenefits.com/workest/what-does-a-pay-stub-look-like/

For the employer, a pay stub is useful for tax filing purposes and to resolve any issues regarding employee pay.

For the employee, a pay stub is a record of their wages, taxes/other deductions, and contributions that allows them to verify that they were paid correctly. A pay stub also serves as a proof of employment and/or income, often necessary information when applying for a loan/credit or applying for a job (if requiring salary history during a job interview is permitted by the state/locality).

Employers are not required by federal law to provide employees with a pay stub, but most states have laws that require some form of a written pay statement. In addition, employers are required by the Fair Labor Standards Act (FLSA) to keep a record of the hours their employees work. Employers should, therefore, provide employees with a pay stub with each paycheck.

The few states that do not require a pay stub are:

-

Alabama

-

Arkansas

-

Florida

-

Georgia

-

Louisiana

-

Mississippi

-

Ohio

-

South Dakota

-

Tennessee

The Fair Labor Standards Act (FLSA), however, does require information regarding employees, including payroll information/hours worked, to be recorded by employers. Employers should, therefore, provide employees with a pay stub with each payroll check.

In "opt-out" states, employers must obtain employees' consent before changing the way they deliver paycheck stubs and must retain the previous method if an employee prefers. In "opt-in" states, employers must offer paper stubs unless an employee chooses to have the stub provided electronically.

Pay Stub Generator

There are several different ways an employer/business owner can create professional pay stubs, depending on their needs. If the design of the pay stub is not significant and the employer wants more control over the information that will be included on the pay stub, they should use software such as Microsoft Word or Microsoft Excel. No-cost web-based programs such as Google Docs and Google Sheets are also excellent options. If design is important, there are many free online tools that will allow an employer to customize their pay stubs.

In the alternative, an employer can purchase payroll software or hire a payroll service. Payroll processing is a time and cost-saving process for a small business.

A pay stub generator creates a (blank) pay stub in four simple steps:

1. Enter the company, employee, and income information.

2. Enter any applicable deductions.

3. Click the "Create pay stub" button.

4. The pay stub will be sent to the employer's email inbox.

A pay stub generator should include the following features:

-

User-friendly.

-

Free.

-

The pay stub has a clean, simple design.

-

The process is instantaneous.

-

Pay stubs are exported in PDF form.

Free Pay Stub Generator:

https://www.shopify.com/tools/pay-stub-generator

Source: https://formswift.com/pay-stub

Posted by: autolightmirror.blogspot.com